Here is what we are going to cover:

- $CRV & $veCRV

- Gauge reward mechanism and $veCRV boosting

- The game theory aspect of $veCRV boosts

- $CRV Emission schedule

This article goes in-depth in explaining the intricacies of the rewards framed around gauge mechanism and $veCRV. The article also lays down the fundamental concept behind the buzzword Curve Wars, and how it plays out at the protocol level.

$CRV emissions are also extensively covered with the numerical data.

If this simple reading layout doesn’t excite you, you could scroll down to consume the same content as if it were a magazine.

⚠ Disclaimer: All information presented here is my perspective and should be considered educational content. I won’t be responsible for any kind of financial profits or losses derived from your decisions. Financial and investment advice

$CRV & $veCRV

Acquiring $CRV

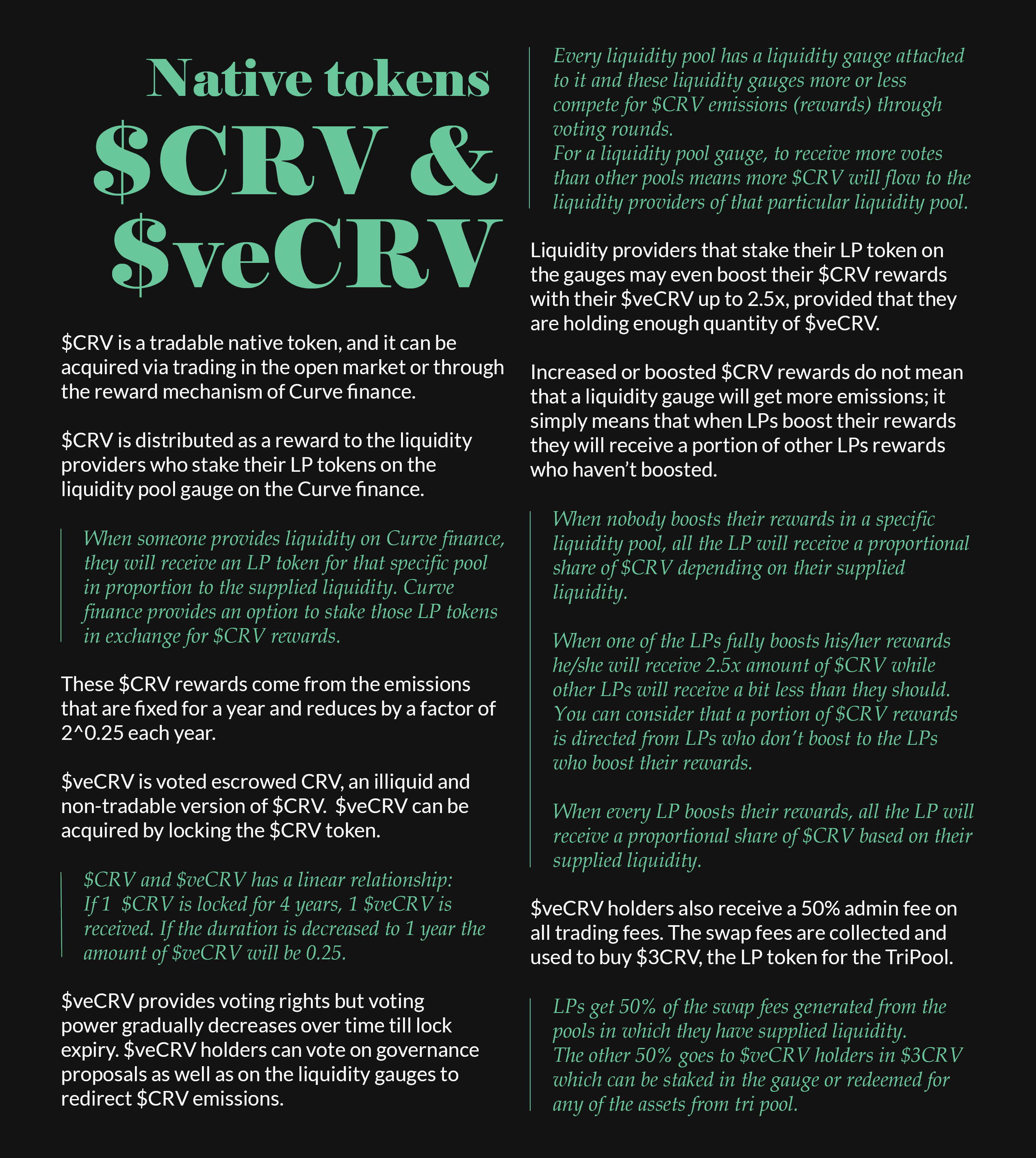

$CRV is a tradable native token, and it can be acquired via trading in the open market or through the reward mechanism of Curve finance.

$CRV is distributed as a reward to the liquidity providers who stake their LP tokens on the liquidity pool gauge on the Curve finance.

When someone provides liquidity on Curve finance, they will receive an LP token for that specific pool in proportion to the supplied liquidity. Curve finance provides an option to stake those LP tokens in exchange for $CRV rewards.

These $CRV rewards come from the emissions that are fixed for a year and reduces by a factor of 2^0.25 each year.

Locking $CRV

$veCRV is voted escrowed $CRV, an illiquid and non-tradable version of $CRV. $veCRV can be acquired by locking the $CRV token.

$CRV and $veCRV has a linear relationship:

If 1 $CRV is locked for 4 years, 1 $veCRV is received. If the duration is decreased to 1 year the amount of $veCRV will be 0.25.

The voting power of $veCRV

$veCRV provides voting rights but voting power gradually decreases over time till lock expiry. $veCRV holders can vote on governance proposals as well as on the liquidity gauges to redirect $CRV emissions.

Every liquidity pool has a liquidity gauge attached to it and these liquidity gauges more or less compete for $CRV emissions (rewards) through voting rounds.

For a liquidity pool gauge, to receive more votes than other pools means more $CRV will flow to the liquidity providers of that particular liquidity pool.

$CRV rewards boost

Liquidity providers that stake their LP token on the gauges may even boost their $CRV rewards with their $veCRV up to 2.5x, provided that they are holding enough quantity of $veCRV.

Increased or boosted $CRV rewards do not mean that a liquidity gauge will get more emissions; it simply means that when LPs boost their rewards they will receive a portion of other LPs rewards who haven’t boosted.

The implication of boosted rewards:

When nobody boosts their rewards in a specific liquidity pool, all the LP will receive a proportional share of $CRV depending on their supplied liquidity.

When one of the LPs fully boosts his/her rewards he/she will receive 2.5x amount of $CRV while other LPs will receive a bit less than they should. You can consider that a portion of $CRV rewards is directed from LPs who don’t boost to the LPs who boost their rewards.

When every LP boosts their rewards, all the LP will receive a proportional share of $CRV based on their supplied liquidity.

Admin Fees

$veCRV holders also receive a 50% admin fee on all trading fees. The swap fees are collected and used to buy $3CRV, the LP token for the TriPool.

LPs get 50% of the swap fees generated from the pools in which they have supplied liquidity.

The other 50% goes to $veCRV holders in $3CRV which can be staked in the gauge or redeemed for any of the assets from tri pool.

Liquidity Gauges & Weights

Curve incentivizes liquidity providers with $CRV, provided they stake their LP token in the liquidity gauge. Each pool has an individual liquidity gauge. This allocation, distribution, and minting of $CRV are managed via several DAO contracts:

LiquidityGauge: Measures liquidity provided by users over time, to distribute $CRV and other rewards.

GaugeController: Central controller that maintains a list of gauges, their weights, and the type to coordinate the rate of $CRV production for each gauge.

Minter: $CRV minting contract, generates new $CRV according to liquidity gauges.

The amount of $CRV emissions/rewards received by a particular liquidity gauge directly depends on the current emission rate, gauge weight, and gauge type weights.

Gauge weight is a portion of $veCRV votes towards that specific liquidity pool. More votes mean more $CRV will flow to the LPs of that particular liquidity pool. The gauge weight is updated every Thursday.

Grouping gauges based on L1 chains allow the DAO to adjust the emissions according to type,

e.g. end all emissions for a single type.

Each user receives a share of newly minted $CRV proportional to the amount of LP tokens staked. As previously discussed, rewards can be boosted by up to a factor of 2.5 if the user vote-locks $CRV to get $veCRV.

Decoding the rewards mechanism

To get the highest $CRV rewards, a user has an option to choose a pool with low liquidity and high gauge weight (Not Financial Advice).

You should assess the risks involved in providing liquidity in such pools before diving in.

Curve war is all about redirecting those juicy $CRV emissions to a specific pool and for doing so one needs a high number of $veCRV votes for that particular gauge.

Newer protocols try to gain a strategic advantage to establish liquidity through these liquidity gauges. Protocol and/or liquidity pool owners compete to gain more votes on their desired liquidity gauge thus incentivizing LPs to provide liquidity in the desired pool.

Protocol and/or liquidity pool owners can acquire an upper hand by accumulating $CRV, locking it, and voting on their desired liquidity pool via $veCRV.

Convex finance is a prominent player and holds more than 50% of the circulating supply of $CRV as $veCRV.

Protocol and/or liquidity pool owners can even use bribes as an incentive to vote in favor of them. A user can choose to manually vote on the desired pool that is offering bribes or can even delegate their votes to receive bribes.

Frax finance is another prominent player which provides bribes and also accumulates governance tokens, it leverages the $CRV and $CVX to establish exceptional liquidity for $FRAX.

$CRV Emissions

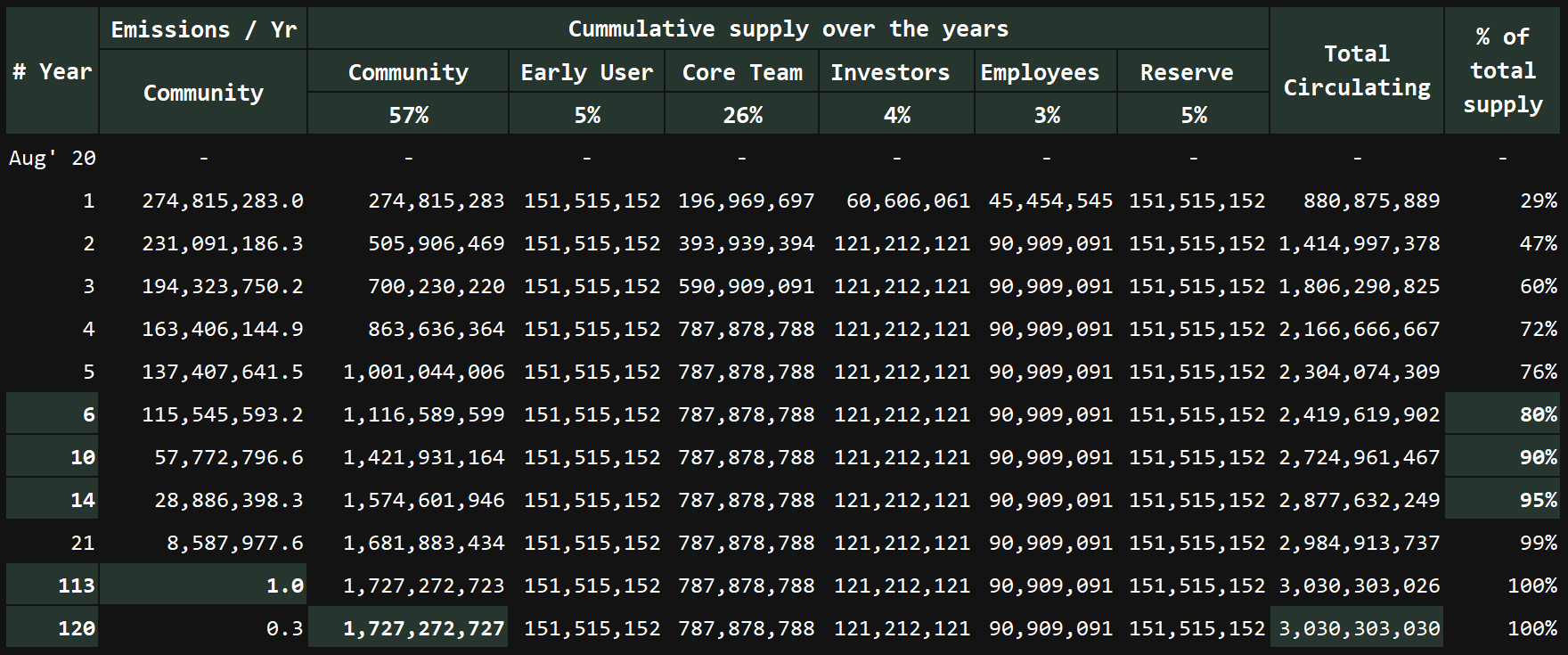

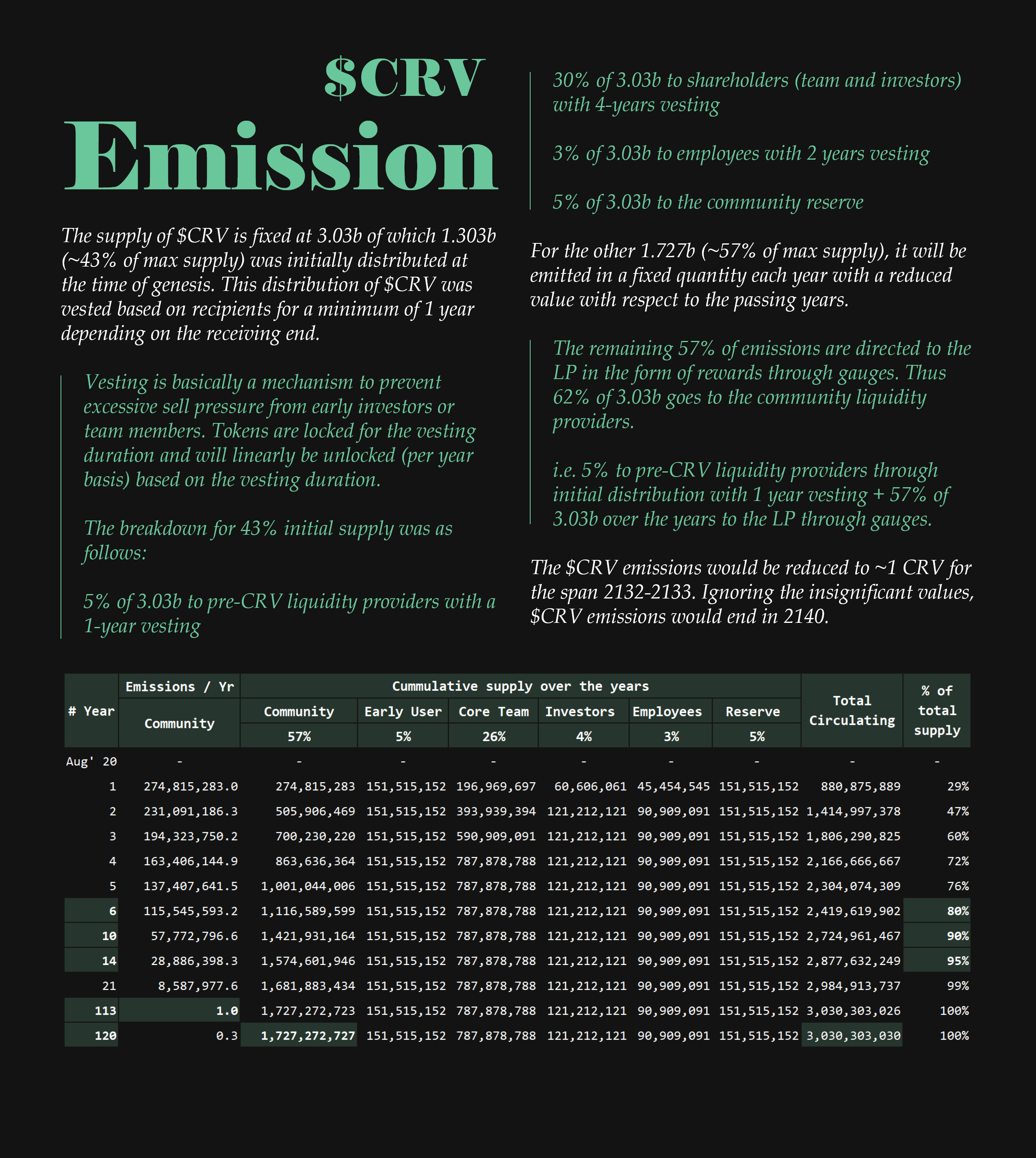

The supply of $CRV is fixed at 3.03b of which 1.303b (~43% of max supply) was initially distributed at the time of genesis. This distribution of $CRV was vested based on recipients for a minimum of 1 year depending on the receiving end.

Vesting is basically a mechanism to prevent excessive sell pressure from early investors or team members. Tokens are locked for the vesting duration and will linearly be unlocked (per year basis) based on the vesting duration.

The breakdown for 43% initial supply was as follows:

5% of 3.03b to pre-CRV liquidity providers with a 1-year vesting

30% of 3.03b to shareholders (team and investors) with 4-years vesting

3% of 3.03b to employees with 2 years vesting

5% of 3.03b to the community reserve

For the other 1.727b (~57% of max supply), it will be emitted in a fixed quantity each year with a reduced value with respect to the passing years.

The remaining 57% of emissions are directed to the LP in the form of rewards through gauges. Thus 62% of 3.03b goes to the community liquidity providers.

i.e. 5% to pre-CRV liquidity providers through initial distribution with 1 year vesting + 57% of 3.03b over the years to the LP through gauges.

The $CRV emissions would be reduced to ~1 CRV for the span 2132-2133. Ignoring the insignificant values, $CRV emissions would end in 2140.

Thank you for being here.

You can provide the same value by sharing this article with your circle.

You could even contribute/support these articles by owning one ✌.

Thank you for being here.

You can provide the same value by sharing this article with your circle.

You could even contribute/support these articles by owning one ✌.