Chicken Bonds are designed to generate amplified yields and accumulate protocol-owned liquidity that can strengthen the subjected asset's position in the market. It is first applied to Liquity’s LUSD where bonding is the primary use case, allowing users to acquire bLUSD at a discount upon depositing tokens.

Though the report consists of a short intro on the mechanics of Chicken Bonds, it is assumed that the reader knows a bit about Chicken Bonds and how it works.

Resources that cover Chicken Bonds as a product:

-

A risk assessment report on bLUSD by the Crypto Risk Team.

-

An article on Chicken Bonds exploring amazing aspects of the product by Token Brice.

-

Official blogs from the team.

-

Chicken Bonds Docs.

NOTE:

The report presents the information and the suggestion with a lens of opportunity cost i.e. a user bonding x amount of LUSD through chicken bonds VS a user investing x amount of LUSD in the yield-generating protocols used by chicken bonds in the same ratio.

INDEX

-

Chicken Bonds Introduction.

-

bLUSD Accrual.

-

Importance of Market Price of bLUSD.

- Impact of bLUSD Market Price on a user’s decisions.

-

Impact of Accrual Parameter.

-

Impact on bLUSD market price.

-

Impact on yield amplification.

-

-

Approaching Non-profitability.

- bLUSD: Buy-pressure & Sell-pressure.

-

Solutions.

-

Reduced effect of Chicken-In fee on the bonder.

-

A stable and growing system.

-

Utility for bLUSD.

-

Chicken Bonds Introduction

Chicken Bonds are a novel mechanism for projects to bootstrap protocol-owned liquidity at no cost while boosting yield opportunities for end users.

Users may deposit LUSD in exchange for an accruing balance of bLUSD. At any time, bond-holders can either:

-

Chicken-Out: Recover the LUSD and forego the accrued bLUSD, or

-

Chicken-In: Trade the bonded LUSD for the accrued bLUSD.

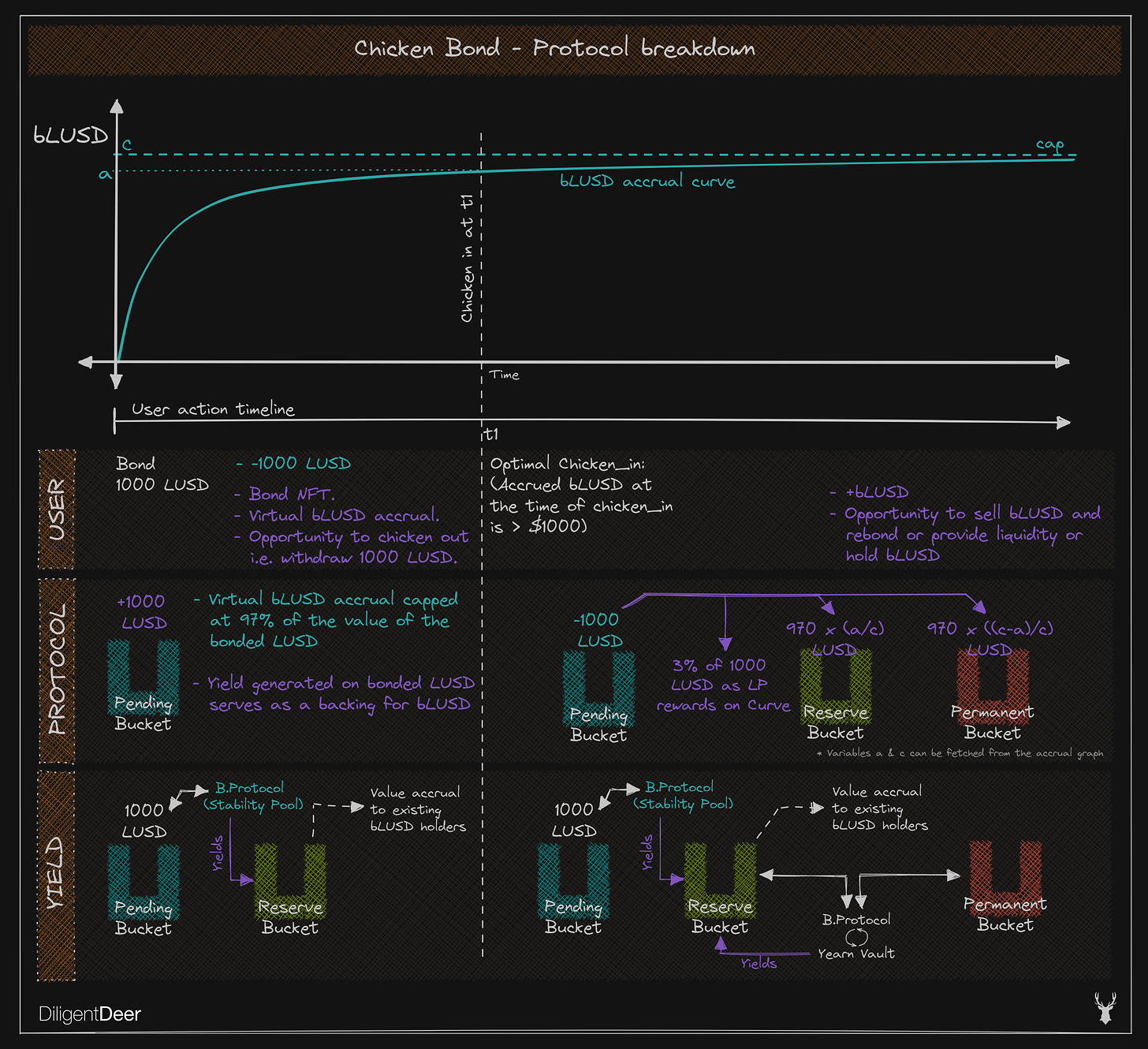

The protocol operates a Treasury consisting of three "buckets": Pending Bucket, Reserve Bucket, and Permanent Bucket.

-

The Pending Bucket (protocol-controlled vault) holds the LUSD gathered from bonding. The funds are invested in the stability pool.

-

The Reserve bucket (protocol-controlled vault) stores a portion of the LUSD gathered from the former bondholders after a "Chicken-in" event. Yields generated with the funds in every bucket are directed to the Reserve bucket. The funds in the Reserve Bucket backs the circulating bLUSD supply, i.e. hard price floor for bLUSD.

-

The Permanent bucket (protocol-owned vault) stores the other portion of the LUSD gathered from the former bondholders.

Here is the Chicken Bonds one-pager:

bLUSD Accrual

For a bonder, the decision to Chicken-In hugely depends on the number of bLUSD accrued so far and the market price.

bLUSD accrual for the bonders is a function of the number of LUSD bonded, the Chicken-in fee, the redemption price of bLUSD, accrual parameter - alpha(α), and time.

*Adjusted Bonded LUSD: 3% Chicken-in fee is subtracted before calculating the s(t) (accrued bLUSD). For example, if a user bonds 10,000 LUSD, 9,700 will be used to calculate bLUSD accrual.

The Redemption Price is the ratio of LUSD in the Reserve Bucket to the bLUSD circulating supply.

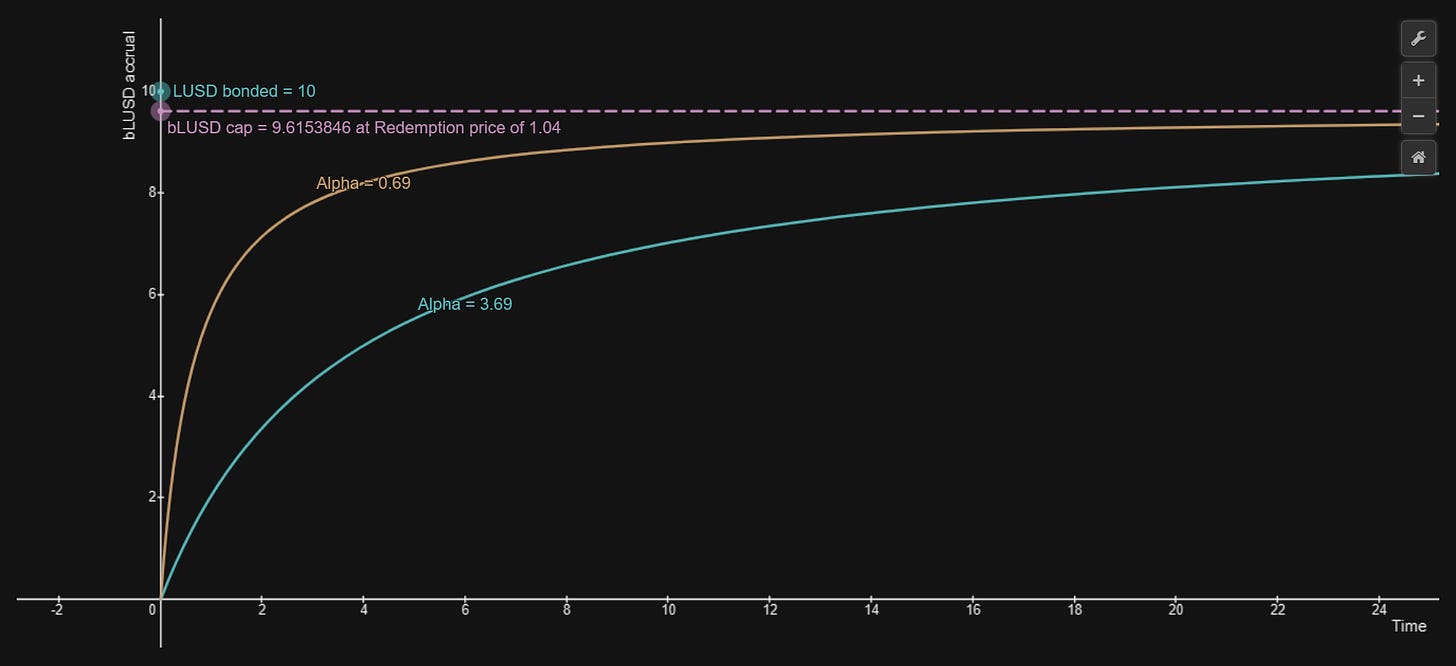

The accrual parameter(α) decides the pace of bLUSD accrual. Here is an example of a bLUSD accrual graph with different values of accrual parameter**(α)**:

Assuming that a user will chicken-in their bond, When a user bonds 10,000 LUSD for a given finite time and accrual parameter(α), accrued bLUSD value (s(t) * Pr) will never reach the value of 9,700 LUSD.

Importance of Market Price of bLUSD

As we have already covered variables impacting the virtual bLUSD accrual, it is equally important to understand the other variable in profitability i.e. the market price of bLUSD. The market price for bLUSD is derived from the bLUSD-LUSD3CRV V2 pool on Curve.

The protocol is designed in such a way that there should be an external liquidity pool where the bonders could sell their bLUSD to realize the profits. The market price of bLUSD needs to be more than the redemption price to ensure the profitability of the bonding endeavor. To be precise, the market price needs to be more than 1.031 times the redemption price (10,000/9,700 = 1.031).

Higher bonding volume may generate a higher bLUSD sell-off after they Chicken-in. To reduce the effect of this sell-off, the protocol is incentivizing the LPs with a 3% Chicken-in fee. Moreover, the team proposed to get a CRV gauge to the bLUSD-LUSD3CRV V2 pool. The liquidity depth on the same pool was increased recently by changing the V2 pool parameter for the same reason discussed above.

Impact of bLUSD Market Price on a user’s decisions

A rising bLUSD market price would result in higher bonding volume, more demand to hold bLUSD (temporary buy-pressure on bLUSD), and the average bond age of the bonders would decrease.

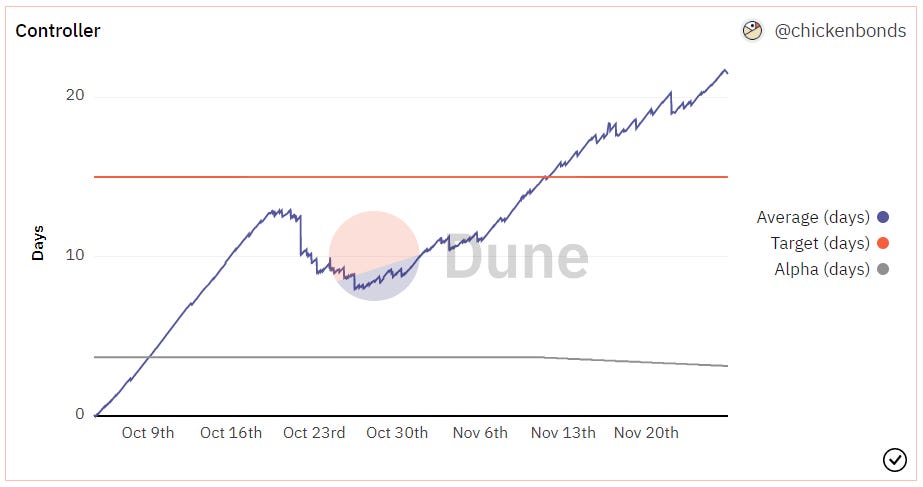

On the other hand, if the bLUSD market price is dropping, the complete opposite of the above would be observed. Moreover, if the average bond age goes beyond 15 days, a controller is triggered that would lower the accrual parameter(α).

Impact of Accrual Parameter

Impact of Accrual Parameter on bLUSD market price

Lowering the alpha(α) would accelerate the bLUSD accrual rate as we saw in the graph earlier.

It is assumed that a self-interested user will only exit after the break-even point or hold the bond until they consider the Chicken-in trade to be profitable to them (here a "profitable trade" should not be considered literal but subjective to the user's intellect). This accelerated bLUSD accrual will change a non-profitable or a low-profit Chicken-in trade to a profitable or a high-profit one via accelerating the bLUSD accrual. When they Chicken-in, the extra profit (which otherwise would not be generated if α was not lowered) will come from the bLUSD inflation, i.e. bLUSD market price.

Impact of accrual parameter on yield amplification.

In a hypothetical case where every bonder is going to Chicken-in, the yield amplification comes from the additional yield generated from the permanent bucket.

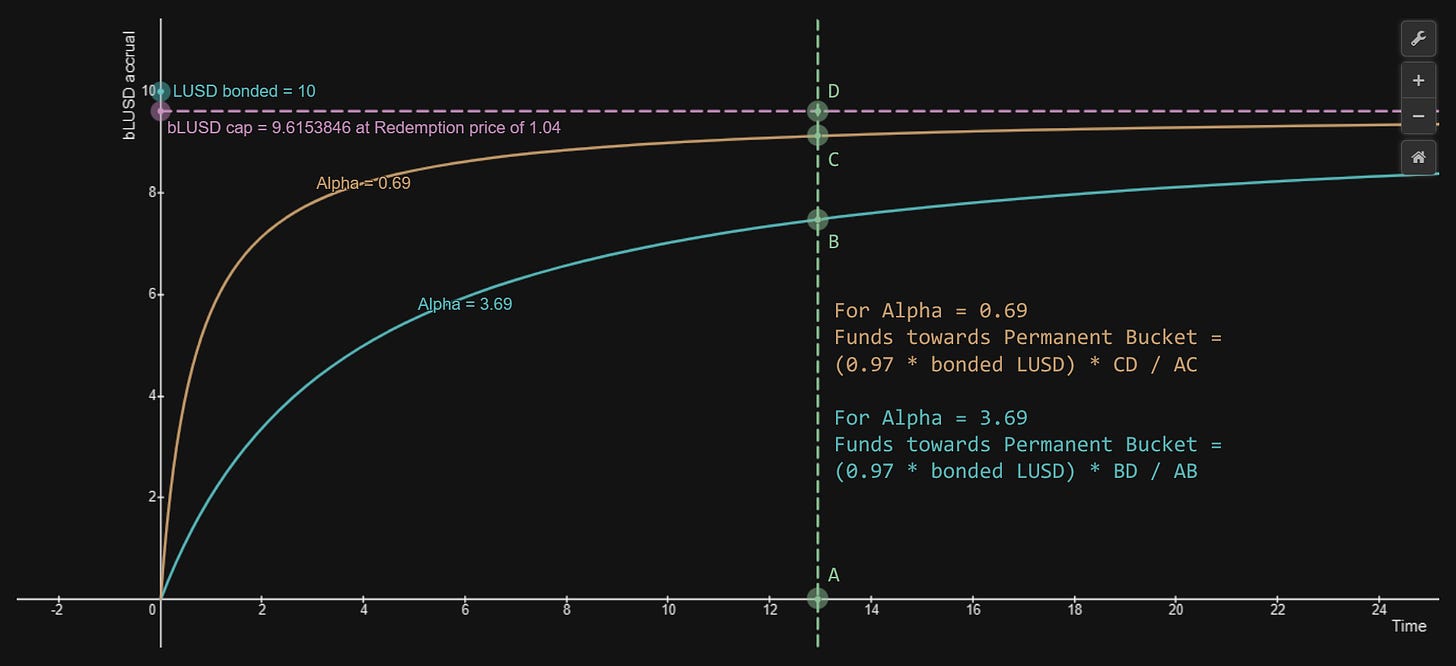

After Chicken-in, the funds move from the Pending Bucket to the Reserve Bucket and the Permanent Bucket. This distribution depends on the bLUSD cap and the accrued bLUSD quantity.

This is best explained in the Chicken Bonds whitepaper:

If the accrual parameter(α) is lowered, the portion of funds going into the Permanent Bucket reduces. Here is the visual version to understand this better:

If the LUSD in the Permanent Bucket per LUSD in the Reserve Bucket drops, the amplification is severely impacted. The market evaluates the bLUSD to be of less value in the case where the amplification is low i.e. reduction in the market price of bLUSD.

Approaching Non-profitability

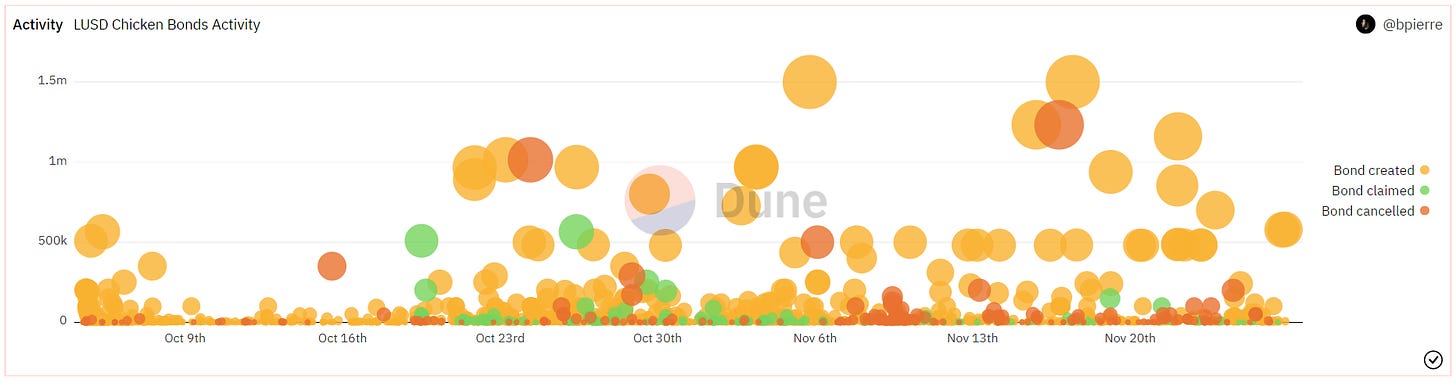

We have already seen how the lowering of the accrual parameter impacts the market price negatively. The controller was already triggered and the alpha is gradually being lowered until the average bond age drops under 15 days.

Source: Dune Query

Moreover, there is a huge sell-pressure waiting if the current bonders choose to Chicken-in.

Source: Dune Query

The early bonders might be waiting to have enough liquidity on the bLUSD pool to face less price impact i.e. waiting for LPs so bonders can dump their bLUSD. This risk was even highlighted in the risk assessment report on bLUSD by the Crypto Risk Team.

bLUSD: Buy-pressure & Sell-pressure

Following are the scenarios where bLUSD’s market price would directly or indirectly rise:

-

If an LP provides single-sided (LUSD) liquidity to the pool.

-

If a user chicken-out after bonding for a considerable time.

-

If a user chicken-in early.

-

If a user redeems their bLUSD and takes a loss.

For a rational, self-interested individual, 2,3 & 4 are highly unlikely.

If the reduction in the market price due to the lowering of alpha and due to the selling of bLUSD is greater than the price increase in bLUSD due to the above factors, there would be a price drop. If the market price goes beyond 1.031 times the redemption price there would not be a single profitable trade.

Solution/s

-

Let the accrual parameter be a fixed rather than a reducing variable.

-

Let us bifurcate the yield coming from the permanent bucket into 3 parts:

-

A portion of this yield goes to the Reserve Bucket as per the current design.

-

A portion goes to the LPs who are providing liquidity in bLUSD-LUSD3CRV.

-

A portion goes to the 4th bucket called the “Boosted Bucket”.

-

-

Let us alter the bLUSD accrual equation in such a way that we replicate the effect of Chicken-in fees for the bonders but utilize those funds towards the Permanent Bucket. It could be as simple as a 2% Chicken-in fee that will be collected in the Permanent Bucket.

The 4th bucket (Boosted Bucket) will drive the demand for bLUSD as well as reduce the selling pressure. Bonders can stake their bLUSD in a vault to get ultra-boosted yield (pardon my nomenclature). This is the same mechanic that Curve Finance is already using to distribute its CRV emissions. Locking CRV = Staking bLUSD, CRV emission = LUSD from the 4th bucket, only distribution of LUSD would change regardless of the amount accumulated.

Let us check what we did and how will it improve the situation.

Reduced effect of Chicken-In fee on the bonder

Bonding is more profitable even if we keep the same value of Chicken-in fees as there exists a chance to get a portion of that fee as yield through staking bLUSD.

In this system, it is guaranteed that incentives going toward the LPs will keep on growing provided the yield generated from the LUSD in the Permanent Bucket never drops.

Utility for bLUSD can also result in higher trading activity under the bLUSD-LUSD3CRV pool increasing the vAPY which can be higher than what we have right now.

A stable and growing system

We overcame the downside of lowering the accrual parameter.

In this system, the yield would not be super fancy like we have right now but will be amplified for sure. On the plus side, the funds moving into the Permanent Bucket never reduces. Thus positive and growing incentives for bLUSD staker, LPs, and bonders.

Utility for bLUSD

In the current design, there is no utility of bLUSD other than holding it. In this solution, users can buy bLUSD to capture the price upside as well as get more yield on their bonds via staking.

Thank you* for reading 🙌.*

You can provide the same value by sharing this article with your circle.

Subscribe!* I write about interesting protocol mechanisms, insights, and analyses.*

You can even contribute/support these articles by owning one ✌.