Here is what we are going to cover:

- The functionality of $FXS and $FXS emissions

- $veFXS and Gauge voting

- Gauge mechanism and incentive boosts

This article provides an in-depth functionality of $FXS and $veFXS within the FRAX protocol. The focus is to understand the rewards mechanism and different boosts.

If this simple reading layout doesn’t excite you, you could scroll down to consume the same content as if it were a magazine.

⚠ Disclaimer: All information presented here is my perspective and should be considered educational content. I won’t be responsible for any kind of financial profits or losses derived from your decisions. Financial and investment advice

Frax Share token ($FXS)

The Frax Share token ($FXS) is a volatile native utility token as well as a governance token for Frax finance.

This is what Frax finance has to say about the governance rights of the $FXS token:

Parameters that are up for governance through FXS include adding/adjusting collateral pools, adjusting various fees (like minting or redeeming), and refreshing the rate of the collateral ratio.

$FXS is designed to absorb the presumed volatility of the $FRAX stablecoin.

The supply of $FRAX token is directly liked to $FXS token provided that the collateral ratio (CR) is lower than 100%. Minting and redemption of $FRAX token would be done through burning and minting of a portion of the $FXS tokens, thus absorbing the volatility of FRAX stablecoins.

Frax finance is designed in such a way that as long as $FRAX stays in demand the $FXS token would be largely deflationary in supply.

In case of higher demands for $FRAX, $FXS will be burned (a 1-CR portion of $FRAX value).

Burning will squeeze the supply for $FXS meanwhile the collateral reserve increases and AMO makes more profits. AMOs can be considered as independent mechanisms within the protocol from which Frax finance makes money. $FXS with its reduced supply would be in greater demand as the AMO profits would get accrued to $FXS as well.

With the collateral ratio function, $FXS would not lose its value at the same pace in the situation where $FRAX demand is lowering.

At the time of lowering demand for $FRAX, the CR would increase and the collateral quantity would be affected more when $FRAX redemption occurs.

Though $FXS minting would not be so significant, higher the collateral ratio, higher will be the impact on AMO profits as the collateral quantity is decreasing.

$FXS can be considered a leveraged position where the value depends on the $FRAX’s demand.

$FXS Distribution

The initial distribution of Frax Finance’s $FXS token is as follows:

60% – Liquidity Programs / Farming / Community (Via gauges & governance halving naturally every 12 months).

5% – Allocated to the project treasury, grants, partnerships, and security bug bounties

20% – Team / Founders / Early Project Members (12 months, 6-month cliff).

12% – Accredited Private Investors (2% unlocked at launch, 5% vested over the first 6 months, 5% vested over 1 year with a 6-month cliff).

3% – Strategic Advisors / Outside Early Contributors (36 months).

$FXS supply is capped at 100M and cannot go beyond it in any circumstances.

$veFXS & Gauge mechanism

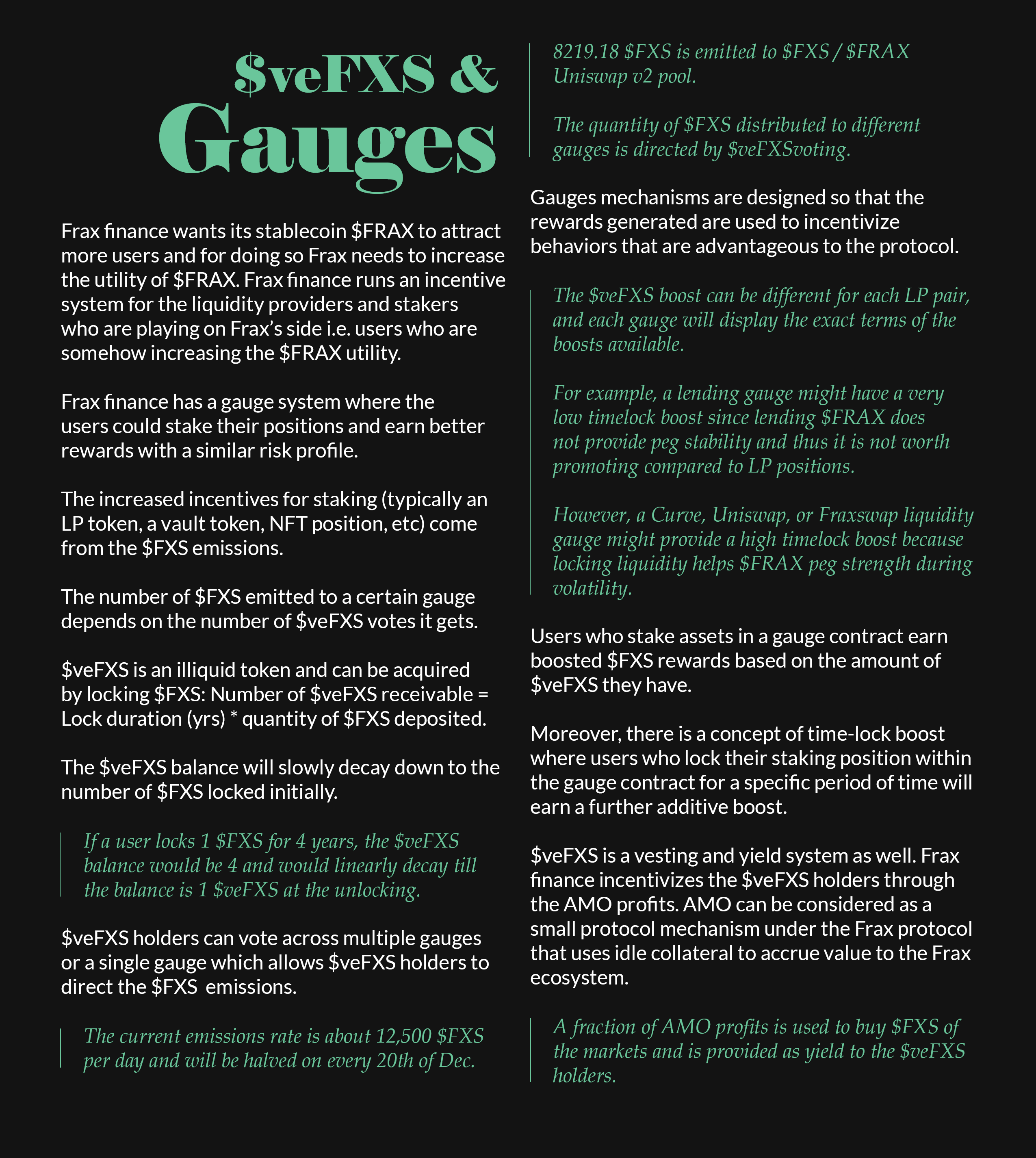

Frax finance wants its stablecoin $FRAX to attract more users and for doing so Frax needs to increase the utility of $FRAX. Frax finance runs an incentive system for the liquidity providers and stakers who are playing on Frax’s side i.e. users who are somehow increasing the $FRAX utility.

Staking in Liquidity Gauge

Frax finance has a gauge system where the users could stake their positions and earn better rewards with a similar risk profile.

The increased incentives for staking (typically an LP token, a vault token, NFT position, etc) come from the $FXS emissions.

The number of $FXS emitted to a certain gauge depends on the number of $veFXS votes it gets.

$veFXS

$veFXS is an illiquid token and can be acquired by locking $FXS: Number of $veFXS receivable = Lock duration (yrs) * quantity of $FXS deposited.

The $veFXS balance will slowly decay down to the number of $FXS locked initially.

If a user locks 1 $FXS for 4 years, the $veFXS balance would be 4 and would linearly decay till the balance is 1 $veFXS at the unlocking.

$FXS emissions

$veFXS holders can vote across multiple gauges or a single gauge which allows $veFXS holders to direct the $FXS emissions.

The current emissions rate is about 12,500 $FXS per day and will be halved on every 20th of December.

8219.18 $FXS is emitted to $FXS / $FRAX Uniswap v2 pool.

The quantity of $FXS distributed to different gauges is directed by $veFXSvoting.

Gauge mechanism and incentives/boost

Gauges mechanisms are designed so that the rewards generated are used to incentivize behaviors that are advantageous to the protocol.

The $veFXS boost can be different for each LP pair, and each gauge will display the exact terms of the boosts available.

For example, a lending gauge might have a very low timelock boost since lending $FRAX does not provide peg stability and thus it is not worth promoting compared to LP positions.

However, a Curve, Uniswap, or Fraxswap liquidity gauge might provide a high timelock boost because locking liquidity helps $FRAX peg strength during volatility.

Users who stake assets in a gauge contract earn boosted $FXS rewards based on the amount of $veFXS they have.

Moreover, there is a concept of time-lock boost where users who lock their staking position within the gauge contract for a specific period of time will earn a further additive boost.

$veFXS is a vesting and yield system as well. Frax finance incentivizes the $veFXS holders through the AMO profits. AMO can be considered as a small protocol mechanism under the Frax protocol that uses idle collateral to accrue value to the Frax ecosystem.

A fraction of AMO profits are used to buy $FXS off of the markets and is provided as yield to the $veFXS holders.

Thank you for being here.

You can provide the same value by sharing this article with your circle.

You could even contribute/support these articles by owning one ✌.

Thank you for being here.

You can provide the same value by sharing this article with your circle.

You could even contribute/support these articles by owning one ✌.