This Risk report was made possible with the collaboration of @cryptorisksteam.

OFAC, the Treasury Department's sanctions watchdog, added Tornado Cash to its list of specially designated nationals on allegations it helped North Korea's Lazarus hacking group launder millions of dollars' worth of crypto proceeds stolen from various crypto projects over the past two or three years.

Source: US Lawmaker Emmer Asks Treasury Department to Explain Tornado Cash Sanctions

Tornado Cash sanctions came out of nowhere without any prior intimations and hit the DeFi ecosystem. Rune, founder of MakerDAO suggests that it is a wake-up call to the consequences of not picking one of the two paths i.e. the Path of Compliance or the Path of Decentralization.

The Endgame Plan aims to make Maker, intrinsically resilient, which enables Maker to deliver on the promise of creating an Unbiased World Currency (DAI), regardless of how external factors may attempt to impact it.

Source: Endgame plan v3 Complete overview

-

MakerDAO: Overview of the protocol

-

Debt Position

-

Liquidation

-

$DAI demand & supply levers

-

-

$DAI and the Endgame Plan

-

The Goal of the Endgame

-

A path towards being intrinsically resilient

-

Current Collateral status

-

-

The $DAI free float proposal

-

The $DAI Endgame Timeline

- Exploring the certainty of free-floating $DAI

-

Impact on Curve Finance

-

Understanding the utility of $DAI with respect to Curve Finance

-

Implications of $DAI free-float on $DAI liquidity on Curve Finance.

- Solution

-

Implications of $DAI free-float on $DAI derivative token liquidity on Curve Finance.

- Solution

-

MakerDAO: Overview of the protocol

[Resource]

Maker protocol whitepaper

MakerDAO has two active tokens:

-

$DAI, a stablecoin soft pegged to $1.

-

$MKR, a governance token for MakerDAO.

Users can mint $DAI by depositing collateral assets into Maker Vaults within the Maker Protocol. Minting $DAI creates an obligation to repay the debt created by minting $DAI plus a Stability Fee. A borrower can withdraw their collateral after squaring off the outstanding obligation. The Stability Fee is the interest charged on the debt and it must be paid in $DAI only.

Liquidation

One of the risk parameters for choosing an asset to be accepted as collateral is LTV (Loan-to-Value = Debt / Collateral Value) ratio. The MakerDAO sets the maximum permissible LTV for every asset. If the TVL for a vault increases beyond the target LTV the vault is liquidated (according to parameters established by Maker Governance). Whenever the price of collateral decreases or the price of the borrowed assets increases, the LTV of the debt position increases.

$DAI demand & supply levers

-

DSR (DAI saving rate): A yield for holding $DAI, which is funded directly from the Surplus Buffer. If the rewards for holding $DAI increase, the demand for $DAI increases.

-

PSM (Peg Stability Module): It allows users to swap given stablecoin collateral directly for $DAI at a fixed rate.

-

A PSM creates the same danger as low liquidation ratio stablecoin vault types: the Maker Protocol will take on a large amount of stablecoin collateral at times where $DAI demand outstrips $DAI supply.

-

This is usually cited to be a risk due to the centralization of other stablecoins and the possibility of regulatory action targeting Maker specifically.

-

The risk of regulatory action may be slightly greater with a PSM because the stablecoin collateral created through a PSM is effectively owned by the Maker Protocol, rather than being owned by a user.

-

-

SFBR (Stability Fee Base Rate): Fees/Interest obligations for a debt position. The supply of $DAI can be controlled by increasing SFBR, high interest implies fewer people taking loans, thus decreased supply (and vice-versa).

$DAI and the Endgame Plan

[Resource]

Aug-24 | Endgame Plan v3 complete overview

Aug-30 | Endgame Plan timeline to free-floating Dai

Sept-02 | Endgame V3 - Collateral Categories - LOD Summary

Data for collateral and $DAI supply: daistats & makerburn

The Goal of the Endgame

Endgame is a path for Maker to deliver on the vision of creating an Unbiased World Currency, a fundamentally resilient infrastructure for both the crypto ecosystem and the global economy.

The Endgame Plan aims to overhaul and improve the Maker Protocol, its governance, and its ecosystem so it can reach a self-sustainable equilibrium called an Endgame State where it is intrinsically resilient … to deliver on the promise of creating an Unbiased World Currency…

Source: Endgame plan v3 Complete overview

A path towards being intrinsically resilient

On the resilience front, the Endgame Plan includes steps to limit the available attack surface.

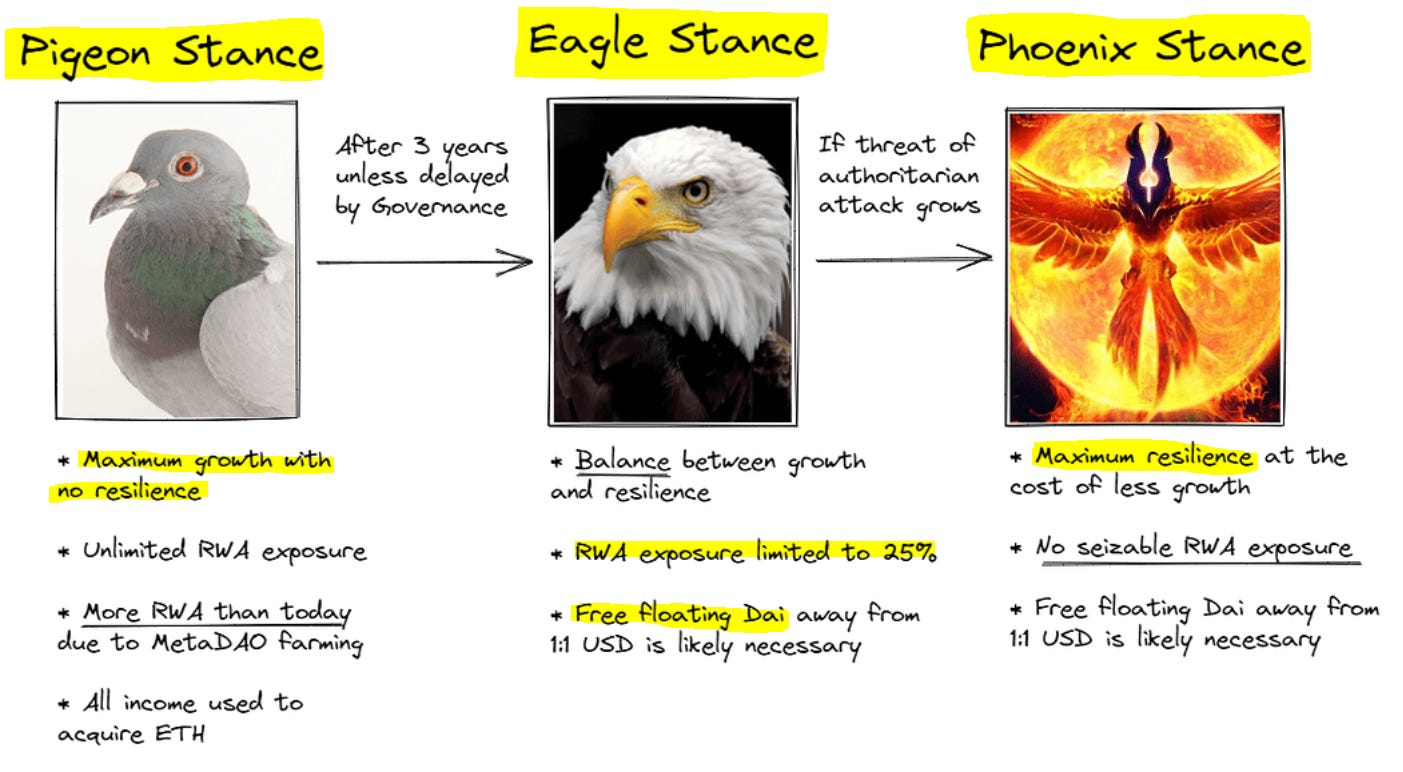

The overall multi-year strategy can be thought of as first focusing on “world currency” by prioritizing keeping the 1:1 USD peg and not putting a limit on RWA exposure, and then switching to focus on “unbiased” by allowing the peg to break and enforcing hard limits on RWA exposure.

Source: Endgame plan v3 Complete overview

RWA is a Real World asset, an investment vehicle similar to $DAI collateral that has the potential to accrue value. These investments are based on the traditional financial system where regulators can leverage these links to take down or regulate the operability of a crypto project.

Here is the distinction between centralized collateral (RWA) and decentralized collateral according to MakerDAO:

In the previous quote, when Rune talks about reducing the RWA exposure, he implies reducing the investments/collateral that is seizable by the regulators. Reducing these attack vectors would make MakerDAO more resilient.

The strategy is broken down into three different stances that signify the concentration of centralized collateral:

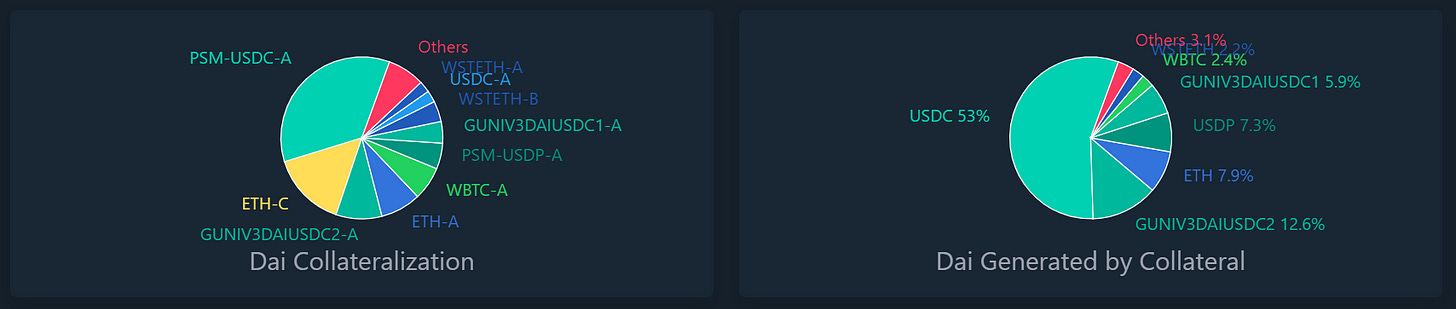

Current Collateral status

The first pie chart shows the distribution of the backing collateral for the $DAI in supply. The second pie chart shows the $DAI generated from a particular collateral type. It is clear from the charts that $USDC is used at a much lower collateral ratio (100%) than other assets like $ETH (170%).

A single RWA i.e. $USDC is backing more than 50% of the $DAI supply, an already exposed surface.

The $DAI free float approach

[Resource]

Aug-26: The Path of Compliance and the Path of Decentralization

For MakerDAO to address the possible regulations, the only possible option is to limit the attack surface to physical threats, specifically the RWA collateral.

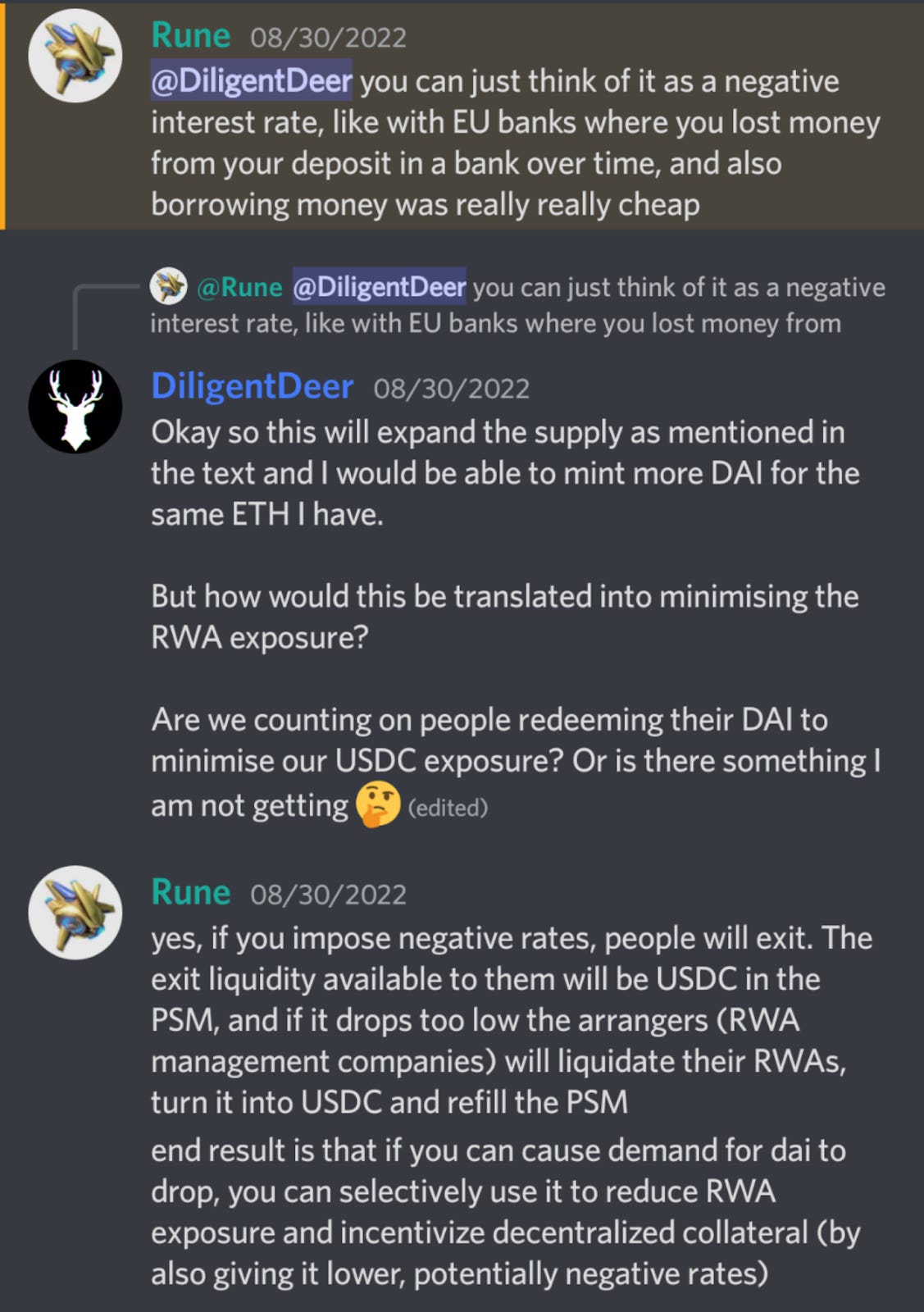

Rune believes the only way to guarantee a hard limit on RWA exposure is to allow $DAI to free float. If the excess $DAI demand is not catered to via decentralized collateral, imposing negative rates would be inevitable.

A negative rate would produce the same effect as if the DSR & SFBR were negative.

It simply means lowering the PSM redemption rate to buyback $DAI and getting rid of centralized collateral.

Free floating DAI can be a very hard reality to accept, but there is unfortunately no way around it … So our only choice is to prepare and do everything we possibly can to make it a transition that Maker can survive…

Source: The Path of Compliance and the Path of Decentralization.

The forum post further expands on 2 powerful tools that can make free-floating $DAI a success, which implies that Rune is envisioning a free-floating $DAI and building around it.

The $DAI Endgame Timeline

[Resource]

Aug-30: Endgame Plan timeline to free-floating Dai

Sept-01: Open Decentralized Voter Committee | Endgame Approval MIP Set

Dai will remain 1:1 with USD for at least 3 years

…

The protocol begins in Pigeon Stance, and the earliest it can switch to Eagle Stance is after 3 years.

Source: Endgame Plan timeline to free-floating Dai

3 years is not a fixed limit and can change based on perceived regulatory risks.

Exploring the certainty of free-floating $DAI

The “3 years to free float” quote is not fixed; the community might delay the switch or could even schedule the switch earlier than mentioned, based on expected regulatory risks.

Free-floating $DAI is likely to happen. Though we are certain about this, the timeline is hard to predict, as it depends heavily on the future regulatory environment.

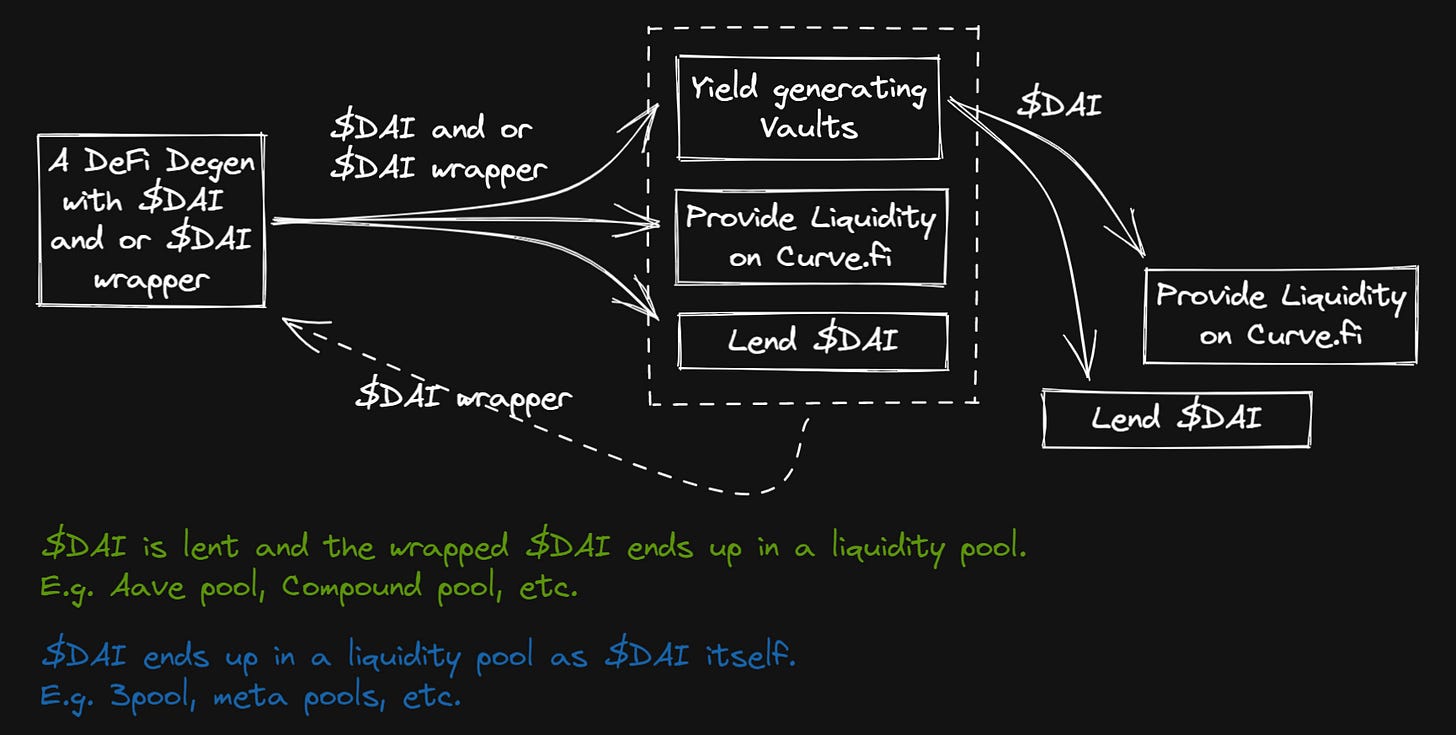

Understanding the utility of $DAI with respect to Curve Finance

This is how a user acts in order to generate a yield by owning $DAI.

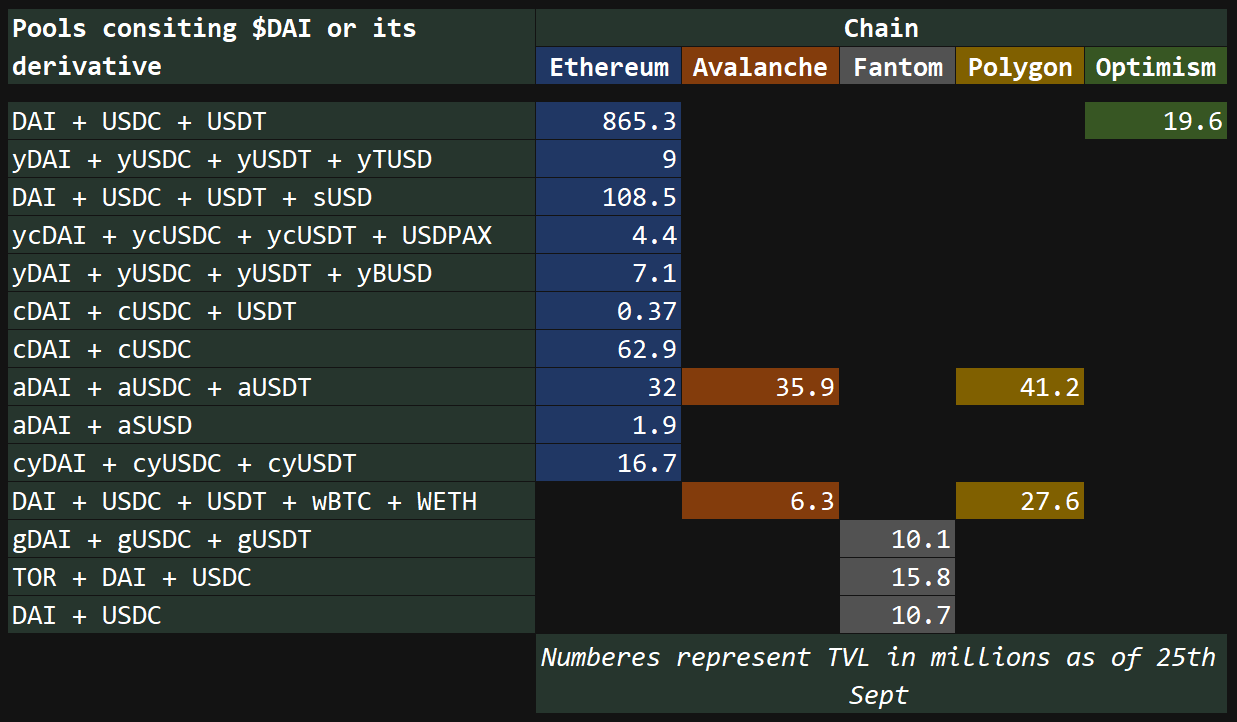

If the $DAI value is to be disturbed, this whole ecosystem would be affected. The impact would be noticed in the below-mentioned Curve finance pools:

Implications of $DAI free-float on $DAI liquidity on Curve Finance.

When the $DAI price drops, people will sell $DAI at the best rates possible. Since PSM will be offering lesser value, people will choose liquidity pools to exit $DAI. 3pool will eventually end up holding more and more $DAI.

Bots and users will be arbitraging between Maker USDC PSM and 3pool, causing $DAI to pile up in the 3pool will get flooded with $DAI.

The reaction of an LP to the above scenario is to remove liquidity(other stablecoins than $DAI) before the 3pool $DAI exchange rate matches that of the PSM's negative redemption rate.

Liquidity would likely drain in the form of $USDC & $USDT; the drain would slow down as the PSM rate approaches the $DAI rates on the 3pool.

Withdrawal of $USDT & $USDC might also impact the $USDC<>$USDT trading pair on the slippage side.

Due to concentrated liquidity, 3pool might face higher IL if nothing is changed.

A possible solution to mitigate losses

Note: Recommendations are made based on the variables that can be controlled as of September 2022. Free-floating $DAI might take a few years to realize (again based on implied risks from regulators). We believe Curve will have better solutions in the future to cope with free-floating $DAI.

Separating $DAI from the 3pool can be an option where $USDC & $USDT can be grouped as a base pool and ($USDC+$USDT)$DAI as a meta pool. The decision of creating a ($USDC+$USDT)$DAI meta pool can be considered based on the situation.

The liquidity concentration of the $USDC+$USDT base pool could be adjusted separately to the $DAI meta pool. When creating a ($USDC+$USDT)$DAI meta pool, the amplification coefficient can be adjusted lower. This would make sure IL resulting from the concentrated liquidity can be mitigated as much as possible. This would also solve the issue of liquidity drain because less volume of assets would be required to bring the price to the PSM rate.

Second order implication of splitting the 3pool

- What happens to the meta pools attached to 3pool?

The ideal approach might be coupling the stablecoins with the new base pool i.e.($USDC+$USDT) base pool but not limited to it.

[$MIM($USDC+$USDT+$DAI)] ➡ [$MIM($USDC+$USDT)]

- If there is no 3pool what will be the new fee token?

A reasonably decent option for creating a fee token in absence of 3CRV could be Tricrypto2 ($wBTC+$WETH+$USDT) LP tokens.

-

This can act as an index token for the LP and won't face huge volatility with respect to individual tokens. Low sell pressure equals more liquidity in the Tricrypto2 pool.

-

Accruing fees in tricrypto2 LP tokens is similar to DCAing into a blue-chip crypto index fund.

If we compare it with an existing product, the fee token representing tricrypto2 can be seen as similar to that of $GLP.

Curve Finance can also consider something that may synergize with their new product i.e. $crvUSD.

Implications of $DAI free-float on $DAI derivative token liquidity on Curve Finance.

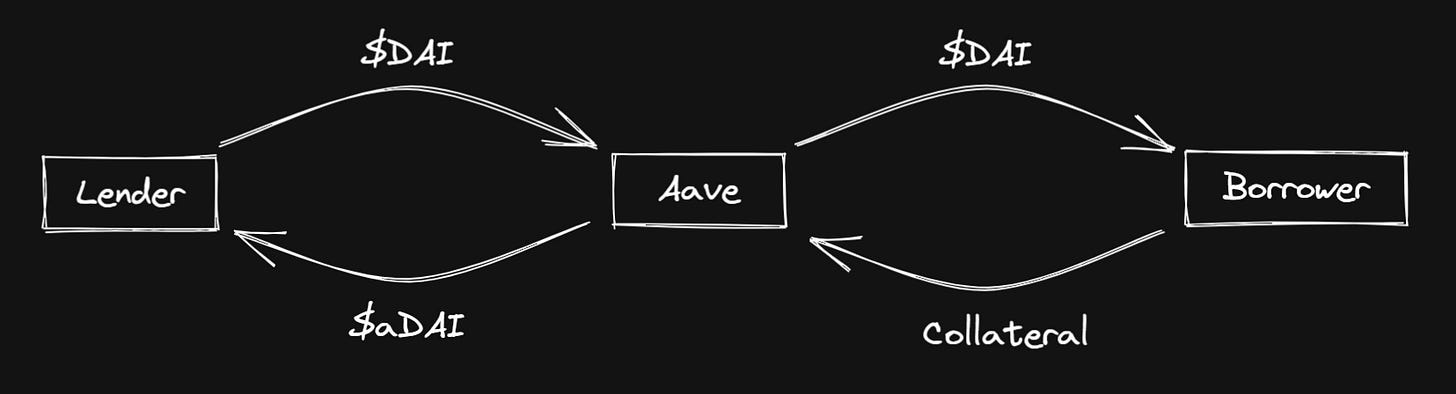

$DAI is being utilized as an investment in lending protocols for yield generation. Here is what the schematic looks like:

In the above relationship, if the value of $DAI decreases (as a result of the Endgame strategy) borrowers will have to pay less amount/value to claim their collateral (the $DAI quantity will remain the same but the value will decrease as the price of $DAI will be forcefully reduced).

Knowing the fact that the $DAI price will decrease, a borrower could take up debt by depositing collateral and withdrawing $DAI.

Every time the $DAI value drops, the borrower could withdraw more $DAI, provided the collateral supplied is enough to maintain the liquidation LTV threshold.

In the above scenario, the Borrower is indirectly leeching the value from the $DAI that was supplied for lending. The lender will no longer be able to withdraw his/her $DAI if he/she wishes to because the Borrower would never square off his/her loan knowing the fact that $DAI would go even lower.

The only solution for the $aDAI holder is to swap it for another token from the Curve’s liquidity pool. Eventually, the liquidity pools will end up with $DAI lending wrappers. This is an apparent loss for the LPs that didn’t react in time.

A possible solution to mitigate losses

Note: Recommendations are made based on the variables that can be controlled as of September 2022. Free-floating $DAI might take a few years to realize (again based on implied risks from regulators). We believe Curve will have better solutions than today in the future to cope with free-floating $DAI.

If the demand for lending $DAI persists at the time of negative rates, the viable solution will be to remove the gauge (stop $CRV rewards) from the current $DAI lending wrapper pools, and form a new pool without the $DAI wrapper. For example, turning $aDAI + $aUSDC + $aUSDT pool into $aUSDC + $aUSDT base pool (with a gauge).

Summary of Recommended Action

The risk team recommends for Curve to:

-

Pass DAO vote for a $USDC + $USDT base pool that receives $CRV emissions

-

Start community discussion to determine a new admin fee token, and make plans to transition before Maker’s Endgame plan initiates

-

Continue monitoring the status of MakerDAO, and its level of commitment to the Endgame plan.

Here is @cryptorisksteam’s substack page with in-depth risk analysis reports.

Thank you for reading 🙌.

You can provide the same value by sharing this article with your circle.

Subscribe! I write about interesting protocol mechanisms, insights, and analyses.

You can even contribute/support these articles by owning one ✌.